BTC Price Prediction: Analyzing the Path to $136,000 and Beyond

#BTC

- Technical indicators show BTC trading above key moving averages with bullish MACD momentum building

- Institutional adoption continues accelerating with major players like Vanguard entering the space

- Regulatory developments and macro factors creating both opportunities and short-term volatility

BTC Price Prediction

Technical Analysis: BTC Shows Bullish Momentum Above Key Moving Average

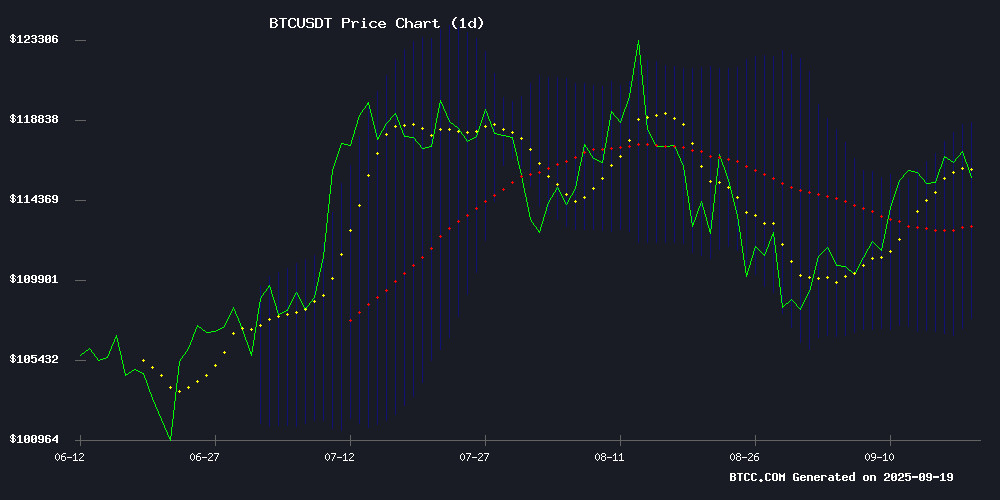

BTC is currently trading at $115,567, positioned above its 20-day moving average of $113,232, indicating underlying strength. The MACD reading of -3,088 suggests ongoing consolidation, though the narrowing histogram hints at potential momentum building. Bollinger Bands show price action NEAR the upper band at $118,715, suggesting possible resistance testing ahead. According to BTCC financial analyst Sophia, 'The technical setup favors continued upward movement, with the $118,700 level serving as the immediate target.'

Market Sentiment: Mixed Signals Amid Regulatory Developments and Institutional Adoption

Market sentiment reflects a complex interplay between regulatory concerns and institutional adoption. While Bank of Japan's ETF unwind and Bitcoin options expiry create near-term uncertainty, significant developments including Vanguard's $50 million Bitcoin purchase and Poland's first Bitcoin ETF demonstrate growing institutional acceptance. BTCC financial analyst Sophia notes, 'The convergence of regulatory progress and institutional investment creates a fundamentally bullish backdrop, though short-term volatility may persist due to macro factors.'

Factors Influencing BTC's Price

Bank of Japan's ETF Unwind Triggers Market Turbulence, Crypto Retreats

The Bank of Japan rattled global markets with plans to unwind its $250 billion ETF and J-REIT portfolio—a legacy of its decade-long ultra-loose monetary policy. Governor Kazuo Ueda confirmed annual sales of ¥330bn ($2.2bn) at book value, emphasizing a glacial pace that would take over a century to fully offload.

While holding rates at 0.5%, the 7-2 vote split revealed growing dissent, fueling speculation of an October hike as August core CPI hit 2.7%. The Nikkei shed 1% and 10-year JGB yields climbed to 1.64%, with Bitcoin mirroring the risk-off sentiment by retreating from $118,000 to $116,000.

The move exposes Japan's fragile fiscal position—a 240% debt-to-GDP ratio and decades-high bond yields loom as structural threats. Rising borrowing costs could destabilize the world's most indebted economy.

Bank of Canada Advocates For Swift Stablecoin Regulation Amid Market Boom

The stablecoin market is expanding rapidly worldwide, prompting governments to update regulatory frameworks. In Canada, the Bank of Canada is pushing for decisive action, urging federal and provincial regulators to collaborate on clear rules for these digital assets.

Ron Morrow, the Bank of Canada’s executive director for payments, supervision, and oversight, highlighted the growing significance of stablecoins at the Chartered Professional Accountants conference in Ottawa. Annual transactions now total roughly $1 trillion, underscoring their mainstream adoption.

Canada’s payment system lags behind global peers, Morrow noted, emphasizing the need for modernization to foster competition and better serve consumers. While Bitcoin remains popular, its volatility renders it impractical for everyday transactions, further bolstering the case for stablecoins.

Metaplanet Receives Buy Rating from Chardan Amid Bitcoin Treasury Expansion

Metaplanet Inc. (MTPLF), Japan's sixth-largest Bitcoin treasury holder, has garnered a buy recommendation from Chardan Capital Markets with a $9.90 price target. The stock surged 14.72% to 608 JPY following the endorsement, attempting to recover from a 70% decline since June.

The investment bank's coverage initiation coincides with Metaplanet's strategic Bitcoin accumulation, now holding 20,136 BTC worth $2.3 billion. Recent purchases of 1,009 BTC for $112 million demonstrate continued conviction in cryptocurrency reserves as a corporate strategy.

New subsidiaries—Metaplanet Income Corp., Bitcoin Japan Inc., and Bitcoin Japan Co., Ltd.—signal institutional commitment to Bitcoin-based revenue streams. CEO Simon Gerovich confirmed $1.4 billion raised through an international offering, capital likely earmarked for further crypto acquisitions.

Bitcoin Faces Crucial Test as $4.9 Trillion in Options Near Expiry

Bitcoin's price remains trapped between critical liquidation zones at $25,000 support and $30,000 resistance as the market braces for a pivotal $4.9 trillion options expiry. The event could trigger heightened volatility, with a breakout in either direction potentially sparking cascading liquidations or renewed bullish momentum.

Altcoins continue to underperform against Bitcoin's dominance, struggling to gain traction amid the market's focus on the impending derivatives event. The options expiry represents a make-or-break moment for short-term price action, with traders positioning for potential explosive moves.

Vanguard Reveals $50 Million Bitcoin Purchase via Metaplanet

Vanguard Group, with $10 trillion in assets under management, has significantly expanded its exposure to Bitcoin through a $50 million investment in Metaplanet. The acquisition of 12.44 million shares underscores a strategic embrace of cryptocurrency by one of the world's largest asset managers.

Metaplanet continues to solidify its position as a leading publicly traded Bitcoin treasury firm, reflecting the accelerating institutional adoption of digital assets. This transaction signals a pivotal shift in traditional finance's approach to cryptocurrency as a legitimate treasury reserve asset.

Poland Debuts First Bitcoin ETF in Eastern Europe

Poland has launched its first Bitcoin ETF, marking a significant milestone for cryptocurrency adoption in Eastern Europe. The bitcoin BETA ETF, now trading on the Warsaw Stock Exchange (GPW), offers regulated exposure to $BTC through futures contracts on the CME, managed by AgioFunds with DM BOŚ as market maker.

The move aligns Poland with Canada and the U.S., where Bitcoin ETFs previously catalyzed institutional inflows. With a 1% management fee and currency risk hedging, the product caters to traditional investors seeking Bitcoin exposure without direct custody challenges.

As Bitcoin's institutional footprint expands, attention turns to scaling utility—a gap projects like Bitcoin Hyper ($HYPER) aim to fill. Poland's 38M population and growing fintech sector could amplify regional crypto adoption.

Golden Trump Statue Holding Bitcoin Erected Near U.S. Capitol

A 12-foot golden statue of former President Donald Trump clutching a Bitcoin appeared outside the U.S. Capitol, sparking intrigue among pedestrians and the crypto community. The installation, funded by anonymous cryptocurrency investors, coincided with the Federal Reserve’s 0.25% interest rate cut—a juxtaposition of political theater and financial symbolism.

The statue stood for seven hours on 3rd Street, its surreal presence underscoring the growing intersection of digital assets and mainstream politics. Organizers framed it as a conversation starter about cryptocurrency’s role in governance. "This is where modern politics meets financial innovation," said spokesperson Hichem Zaghdoudi, alluding to the Fed’s influence over economic policy.

The stunt extended beyond physical spectacle. A memecoin launched on Pump.fun was livestreamed alongside the statue, amplifying the synergy between viral marketing and blockchain utility. The golden Trump figure—part satire, part provocation—embodied crypto’s disruptive ethos.

MetaMask Token Confirmed as Airdrop Season Heats Up

Crypto markets pulled back slightly after their post-FOMC rally, with Bitcoin dipping 1% to $116,300. The spotlight, however, remains on impending token launches and airdrops as major protocols signal upcoming distributions.

Consensys co-founder Joe Lubin confirmed a MetaMask token is coming "very soon," marking the first official acknowledgment of its existence. While betting markets peg a September launch at just 3% odds, the announcement shifts the conversation from speculation to anticipation.

OpenSea advanced to the final phase of its pre-token rewards program, hinting at details in early October. Meanwhile, Base's Jesse Pollak openly discussed the L2's token plans, adding to the growing list of protocols preparing for TGEs.

In a notable recovery, NBA star Kevin Durant regained access to a long-lost Coinbase wallet containing Bitcoin purchased at $600—a stark reminder of crypto's appreciation potential.

Bitcoin Price Prediction: Analyst Foresees 70% Correction in Next Bear Market

Into the Cryptoverse founder Benjamin Cowen predicts Bitcoin could plummet to $37,000—a 70% drawdown from its next cycle peak. The forecast emerges as BTC dominance slides to 57.16%, its lowest since February, signaling capital rotation into altcoins.

The altcoin season index surpassing 80 underscores shifting investor preferences. Market participants remain divided on Bitcoin's trajectory, with Cowen's analysis rooted in historical cycle patterns. Liquidity migration suggests altcoins may outperform in the near term, though BTC's long-term store-of-value narrative persists.

Bitcoin Volatility Surges as Binance Amasses $42B in Stablecoin Liquidity

Bitcoin's market dynamics are flashing warning signs as Binance accumulates a record $42 billion in stablecoin reserves. The exchange's liquidity buildup, which includes $5 billion added in September alone, suggests strategic positioning ahead of potential post-FOMC volatility. Historical patterns reveal a striking correlation: during the 2024 U.S. election rally, Binance's stablecoin reserves grew from $18 billion to $32 billion as BTC surged 54.3% to $108,000.

The current market structure shows a growing divergence between spot and derivatives activity. While spot buyers remain hesitant, leveraged perpetual traders are driving a fragile uptrend. This echoes the fragile pre-election rally conditions, where derivatives speculation outpaced organic demand before Bitcoin's eventual breakout.

Bitcoin Eyes $136,000 by October as MACD Signals Bullish Breakout

Bitcoin's technical indicators suggest a significant rally may be imminent, with the MACD flashing a bullish signal. Analysts project a potential surge to $136,000 within the next 4-6 weeks, contingent on breaking through immediate resistance at $117,900. The 20-day SMA at $113,260 provides a sturdy support floor.

Market forecasts reveal striking divergence among analysts. While U.Today maintains a conservative $113,000-$114,000 short-term target, AMB Crypto's September projection of $136,081 aligns with the current technical setup. CoinCodex's year-end target of $177,384 would represent a 180% gain from current levels—a testament to Bitcoin's asymmetric upside potential.

The consensus tilts decisively bullish, with even bearish scenarios maintaining prices well above psychological support levels. This market structure suggests accumulating strength beneath the surface, as institutional flows and macroeconomic tailwinds converge.

BTC Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technical indicators and market developments, BTC shows strong potential for continued growth. The combination of institutional adoption, regulatory clarity, and technical breakout patterns suggests a positive long-term trajectory. While short-term volatility may occur due to options expiry and macro factors, the underlying trend remains bullish.

| Year | Price Prediction (USD) | Key Drivers |

|---|---|---|

| 2025 | $130,000 - $150,000 | ETF approvals, institutional adoption |

| 2030 | $250,000 - $350,000 | Global adoption, scarcity premium |

| 2035 | $500,000 - $750,000 | Store of value narrative, digital gold |

| 2040 | $1,000,000+ | Full institutional integration, global reserve asset |

BTCC financial analyst Sophia emphasizes that 'these projections assume continued adoption and favorable regulatory developments, with potential corrections along the way representing buying opportunities rather than trend reversals.'